Forex trading is an inherently risky endeavor, but with the right tools, strategies, and mindset, traders can improve their chances of success. One of the most essential concepts in Forex trading is the Risk-to-Reward Ratio (R/R Ratio).

It is a simple yet powerful tool that helps traders manage risk and assess the potential for profit in any trade. This article explores how you can use the Risk-to-Reward Ratio to improve your Forex trading strategy, enhance decision-making, and increase profitability.

What is the Risk-to-Reward Ratio?

The Risk-to-Reward Ratio is a simple formula used to compare the potential risk of a trade to its potential reward. Essentially, it helps traders determine if the potential reward justifies the risk they are about to take.

- Risk: The amount a trader is willing to lose on a trade.

- Reward: The amount a trader stands to gain if the trade goes in their favor.

For example, if a trader is willing to risk $100 to potentially earn $300, the Risk-to-Reward Ratio is 1:3. This means for every $1 risked, the trader expects to make $3 in profit.

Why the Risk-to-Reward Ratio Matters

- Helps Manage Risk: By assessing the potential reward against the risk, traders can make more informed decisions.

- Protects Capital: A solid risk-to-reward framework reduces the likelihood of significant losses.

- Improves Consistency: With a defined risk-to-reward strategy, traders are better positioned to stick to their plan and make disciplined decisions.

- Enhances Profits Over Time: Traders who maintain a favorable risk-to-reward ratio can potentially be more profitable, even if they win only 50% of their trades.

How to Calculate the Risk-to-Reward Ratio

The formula for calculating the Risk-to-Reward Ratio is:

Risk-to-Reward Ratio=Amount at Risk \ Potential Reward

Where:

- Amount at Risk is the difference between your entry price and stop-loss price.

- Potential Reward is the difference between your entry price and take-profit price.

Example 1:

- Entry price: 1.2500

- Stop-loss: 1.2450 (50 pips risked)

- Take-profit: 1.2600 (100 pips potential reward)

The Risk-to-Reward Ratio is: 50 pips100 pips = 1:2100 pips50 pips=1:2

Setting an Optimal Risk-to-Reward Ratio

The key to using the R/R Ratio effectively is finding the optimal balance between risk and reward. A commonly recommended R/R ratio in Forex trading is 1:2, which means that for every $1 you risk, you aim to make $2. However, the ideal ratio can vary depending on your trading style, strategy, and market conditions.

Common Risk-to-Reward Ratios:

- 1:1 – Balanced, but risky; requires a higher win rate to break even.

- 1:2 – A moderate ratio, good for consistent gains with a reasonable win rate.

- 1:3 – Aggressive and profitable in the long run, but requires careful risk management and precise strategy execution.

Implement the Risk-to-Reward Ratio

1. Determine Your Risk Tolerance

Before setting a risk-to-reward ratio, you must first understand how much risk you’re willing to take on a single trade. This typically depends on your risk tolerance, which should be aligned with your overall trading goals.

- Recommended Risk per Trade: A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. For example, if your account balance is $10,000, you should risk no more than $100–$200 per trade.

2. Set Stop-Loss and Take-Profit Levels

The next step is to define your stop-loss and take-profit levels based on the risk-to-reward ratio you’ve chosen. A well-defined stop-loss ensures you limit potential losses, while a take-profit level locks in profits once your target is met.

- Stop-Loss: Set your stop-loss based on key technical levels, such as support/resistance, moving averages, or volatility measures.

- Take-Profit: Aim for a profit target that aligns with the risk you are willing to take. The R/R ratio can guide your decision on how far to set your take-profit level.

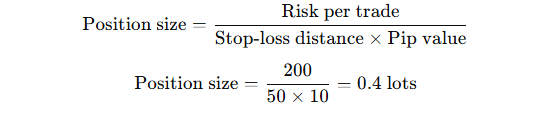

3. Adjust Position Size

Your position size plays a crucial role in determining your risk per trade. Once you’ve established your stop-loss level, calculate your position size to ensure you’re staying within your predetermined risk tolerance.

Example:

- Account balance: $10,000

- Risk per trade: 2% ($200)

- Stop-loss distance: 50 pips

- Value of 1 pip: $10

To calculate the position size:

Benefits of Using the Risk-to-Reward Ratio

- Reduces Emotional Stress: Knowing your risk level ahead of time removes emotional decision-making during the trade.

- Disciplined Trading: With a fixed risk-to-reward ratio, you are more likely to stick to your plan, avoiding impulse trades.

- Long-Term Profitability: By focusing on risk-reward over individual trade outcomes, you can be profitable even if your win rate is below 50%.

Common Mistakes

- Not Following the Plan: Traders often disregard their predefined stop-loss and take-profit levels due to emotional reactions, like fear or greed.

- Setting Unrealistic Ratios: While higher ratios like 1:3 are tempting, they are often difficult to achieve in practice. Aiming for such a high ratio without a solid strategy can lead to more losses than profits.

- Ignoring Market Conditions: The effectiveness of a risk-to-reward ratio depends on market conditions. During high volatility, for instance, it may be challenging to hit higher reward targets.

- Risking Too Much: A common mistake is risking too much on a single trade in hopes of large returns. This can lead to significant losses when a trade goes against you.

Advanced Risk-to-Reward Ratio Techniques

1. Use of Multiple Time Frames

To refine your risk-to-reward strategy, you can use multiple time frames to assess the broader market trend. By confirming the trend on a higher time frame (e.g., daily or weekly chart), you can ensure that your stop-loss and take-profit levels are aligned with the overall market direction.

2. Risk-to-Reward Ratio with Trailing Stops

A trailing stop can be a useful tool in improving your R/R ratio. As the trade moves in your favor, you can adjust the stop-loss to lock in profits, which can help you capture more significant moves while maintaining an acceptable risk.

3. Dynamic Position Sizing

Rather than using a fixed position size, you can adjust your position size based on the volatility of the market. For example, during periods of high volatility, you may opt for a smaller position size to keep your risk within acceptable levels.

Risk-to-Reward Ratio Table Example

| Trade | Entry Price | Stop-Loss Price | Take-Profit Price | Risk (pips) | Reward (pips) | R/R Ratio |

|---|---|---|---|---|---|---|

| Trade 1 | 1.2500 | 1.2450 | 1.2600 | 50 | 100 | 1:2 |

| Trade 2 | 1.5000 | 1.4950 | 1.5150 | 50 | 150 | 1:3 |

| Trade 3 | 1.3200 | 1.3150 | 1.3300 | 50 | 100 | 1:2 |

Wrap Up

Incorporating the Risk-to-Reward Ratio into your Forex trading strategy is one of the most effective ways to manage risk, protect your capital, and improve profitability. By calculating the potential risk and reward for every trade and adhering to a disciplined strategy, traders can significantly increase their chances of success in the highly volatile world of Forex.

Remember that while the Risk-to-Reward Ratio is a powerful tool, it should not be used in isolation. A solid strategy that incorporates sound money management, technical analysis, and psychological discipline is essential to long-term success. Stay patient, remain disciplined, and use the R/R ratio as a guide to make more informed, strategic decisions in your trading journey.