What is Market Value?

Market value is the current price at which an asset, security, or investment can be bought or sold in the

Forex Market Trends offers you the latest market insights and real-time Forex market data to help you stay informed and make better decisions in the dynamic currency markets. Whether you’re new to Forex trading or an experienced trader, our expert analysis, market trends, and trading strategies will guide you toward making more confident and informed trading choices.

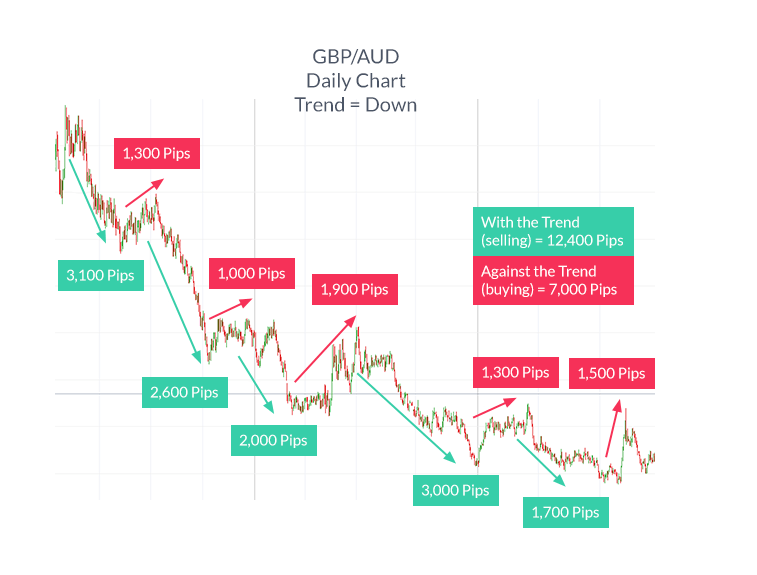

Market trends in Forex play a pivotal role in guiding your trading decisions. By analyzing the direction in which the market is moving, traders can identify profitable opportunities and improve their chances of success.

The Forex market is the world’s largest financial market, boasting a daily trading volume that surpasses $6 trillion. Unlike traditional stock markets, Forex operates 24/5 and is decentralized, allowing individuals, businesses, and institutions to exchange currencies across the globe.

Due to its massive size and liquidity, the Forex market offers traders opportunities to profit from fluctuations in currency prices. However, its inherent volatility also means that understanding market trends is essential for making well-informed decisions and managing risk.

There are three main types of Forex market trends:

Learn how to use technical analysis tools to identify Forex market trends.

Implement proven strategies, like trend-following, to capitalize on the market’s natural movements.

Understand how moving averages help smooth price data, making it easier to spot trends and make informed decisions.

Know the use trend lines to predict future price movements and improve your trading accuracy.

Learn how market sentiment indicators can reveal trader psychology and help predict potential price movements.

Understand how economic factors like GDP, inflation, and interest rates drive market trends and currency prices.

Explore how economic news events like elections and trade wars influence Forex trends and currency prices.

Discover how technical indicators like RSI, MACD, and Bollinger Bands help identify trends, reversals, & breakouts.

Want to improve your trading skills and master market trends? Contact us now for expert insights, personalized guidance, and real-time updates.

A Forex market trend refers to the general direction in which the price of a currency pair is moving over a period of time (up, down, or sideways).

There are three main types: Uptrend (bullish), Downtrend (bearish), and Sideways (range-bound).

You can identify trends using technical analysis tools like moving averages, trend lines, and indicators such as RSI or MACD.

Common indicators include RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

To analyze Forex market trends, use tools like technical indicators, trend lines, and market sentiment analysis to understand price movements and make informed decisions.

Market sentiment refers to the overall attitude of traders towards a particular currency pair, which helps predict market movements.

Economic indicators like GDP, inflation, and interest rates influence currency values and can drive market trends.

A: Range trading involves entering trades within established ranges.

A: You can manage risk by using stop-loss orders, position sizing, and continuously monitoring and adjusting your trading strategy.

A: Forex market trends can help predict future price movements, but they are not foolproof and should be used in conjunction with other analysis tools.

Moving averages smooth out price data to show the overall direction of the market, helping you spot trends more clearly.

Market value is the current price at which an asset, security, or investment can be bought or sold in the

Fundamental analysis is a method used to evaluate the intrinsic value of a financial asset by examining various economic, financial,

The Stochastic Oscillator is a popular momentum indicator used in technical analysis. It measures the position of an asset’s price

Forex trading carries a high level of risk and may not be suitable for all investors. CFDs are complex instruments, and due to leverage retail accounts lose money. Before you engage in trading foreign exchange, please make yourself able with its specifics and all the risks associated with it.

Copyright © 2025 forex Market Trends. All Rights Reserved