Forex trading robots, also known as automated trading systems or Expert Advisors (EAs), have revolutionized the world of forex trading. These sophisticated software programs are designed to automate trading activities, execute trades, and generate trading signals based on predefined algorithms and market analysis. By eliminating human emotions from trading decisions, forex robots aim to maximize trading efficiency and profitability. Whether you are a novice trader seeking to simplify your trading process or an experienced trader looking to enhance your strategies, understanding how forex trading robots work and their potential benefits is crucial for achieving success in the dynamic forex market.

What are Forex Trading Robots?

Forex trading robots are automated software programs that analyze the forex market and execute trades on behalf of the trader. These robots are built using complex algorithms and can be programmed to follow specific trading strategies and rules. They operate based on technical indicators, historical data, and market trends to identify profitable trading opportunities and execute trades with precision.

How Do Forex Trading Robots Work?

Forex trading robots operate by utilizing sophisticated algorithms to analyze market conditions and execute trades automatically. These robots are typically integrated with trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which allow them to interact with the forex market in real-time. The core functionality of a forex robot includes scanning the market for trade setups based on predefined criteria, executing trades, and managing them according to the programmed strategy. These criteria are usually based on technical analysis indicators such as moving averages, RSI, and MACD, which help in identifying potential entry and exit points.

The process begins with the robot scanning historical and current market data to identify trading opportunities. Once a potential trade is identified, the robot executes the trade by placing buy or sell orders. After execution, the robot continues to monitor the trade, adjusting stop-loss and take-profit levels as necessary. This continuous monitoring and adjustment help in optimizing trade outcomes by reacting to market movements that occur after the initial trade execution.

Forex robots are designed to operate continuously without human intervention, which allows them to capitalize on market opportunities 24/7. This constant operation helps in capturing short-term market movements that might be missed by manual trading. However, it’s important to note that while forex robots can automate many aspects of trading, they are not foolproof. They require regular monitoring and adjustments to ensure they remain effective under changing market condition.

What are the Benefits of Using Forex Trading Robots?

One of the primary benefits of using forex trading robots is the elimination of emotional decision-making. Human traders often fall prey to emotions like fear and greed, which can lead to poor trading decisions. Forex robots, on the other hand, operate based on strict algorithms and predefined rules, ensuring that trades are executed logically and consistently. This helps in maintaining a disciplined approach to trading, which is crucial for long-term success in the forex market.

Another significant advantage is the ability to trade around the clock. Forex markets operate 24 hours a day, five days a week, and it’s practically impossible for human traders to monitor the markets continuously. Forex robots can operate without fatigue, ensuring that trading opportunities are not missed even when the trader is not actively monitoring the market. This continuous operation allows for better exploitation of market volatility and short-term trends.

Additionally, forex trading robots can perform backtesting, which involves running the trading strategy on historical data to evaluate its effectiveness. This feature allows traders to optimize and refine their strategies before deploying them in live trading, reducing the risk of losses. Backtesting provides valuable insights into how the strategy would have performed in different market conditions, helping traders to make informed decisions and improve their overall trading performance.

What are the Risks and Drawbacks of Forex Trading Robots?

Despite their numerous advantages, forex trading robots are not without risks and drawbacks. One of the main risks is the potential for technical errors. Like any software, forex robots are susceptible to bugs, connectivity issues, and other technical problems that can disrupt trading. For example, a power outage or a computer crash can cause the robot to stop functioning, potentially leading to missed trading opportunities or unexecuted trades. To mitigate this risk, traders should ensure that they have a reliable technical setup, including backups and redundancies.

Another significant drawback is that forex robots are often only as good as the strategies they are based on. If the underlying strategy is flawed or not well-suited to current market conditions, the robot will likely generate poor results. Additionally, many forex robots are over-optimized for historical data, a practice known as curve-fitting, which means they may not perform well in live trading. Traders need to regularly review and adjust their strategies to ensure continued effectiveness.

How to Choose the Best Forex Trading Robot

Choosing the best forex trading robot is crucial for maximizing your trading success and minimizing risks. Here are key factors to consider when selecting a forex robot:

- Performance and Track Record:

- Evaluate the robot’s historical performance, including its win rate, average profit per trade, and drawdowns. Look for robots with consistent profits over an extended period and avoid those with excessive drawdowns, as they indicate high-risk trading strategies.

- Verify the backtesting results on platforms like MyFxBook to ensure the robot has been tested thoroughly on real accounts, not just demo accounts.

- Strategy and Trading Style:

- Understand the trading strategy the robot employs. Some robots are designed for scalping, making multiple small trades throughout the day, while others focus on swing trading, capturing larger price movements over a longer period. Choose a robot that aligns with your trading preferences and risk tolerance.

- Customization and Flexibility:

- A good forex robot should offer customization options to adapt to changing market conditions. Look for robots that allow adjustments to parameters such as stop loss, take profit, and risk management settings. This flexibility helps in fine-tuning the strategy according to your trading goals and market analysis.

- Support and Updates:

- Select a robot from a reputable vendor that offers excellent customer support. Prompt and reliable support is invaluable for troubleshooting and optimizing the robot’s performance. Additionally, ensure that the robot receives regular updates to adapt to market changes and incorporate new features.

- Reviews and Recommendations:

- Read reviews and seek recommendations from other traders who have used the robot. Look for unbiased reviews on trusted forex forums and websites. Real-life experiences and feedback provide valuable insights into the robot’s performance and reliability.

What are the Top Forex Trading Robots in 2024?

Here are some of the top-rated forex trading robots for 2024, known for their performance and reliability:

- Forex Robotron:

- Known for its low drawdown and built-in risk management protocols, Forex Robotron has a proven track record of over 10 years. It regularly updates its algorithms to maintain high performance and stability in various market conditions.

- Waka Waka EA:

- The Waka Waka Expert Advisor is renowned for its long-term profitability and stability. With a nearly five-year streak of profits and a drawdown of only 26%, it is an excellent choice for those seeking consistent returns. It supports multiple currency pairs and offers a 14-day free trial and a 30-day money-back guarantee.

- Perceptrader AI:

- Leveraging machine learning and advanced algorithmic trading, Perceptrader AI offers powerful customization options and integrations with platforms like Chat GPT and Google Bard. It is ideal for active traders looking for a sophisticated trading tool.

How to Develop Your Own Forex Trading Robot

Creating your own forex trading robot can be a rewarding endeavor if done correctly. Here’s a step-by-step guide:

- Define Your Strategy:

- Determine the specific trading strategy you want to automate, including entry and exit points, risk management, and market conditions. This strategy will form the foundation of your robot’s algorithm.

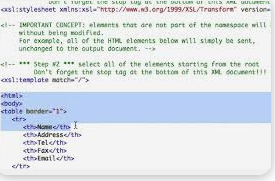

- Coding Your Strategy:

- Use platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which support Expert Advisors (EAs), to code your strategy. These platforms provide the necessary tools and environment to develop and test your trading robot.

- Backtesting and Optimization:

- Run your robot through backtesting using historical market data to evaluate its performance. Optimize the parameters to enhance profitability and minimize risks. This step is crucial for identifying any potential flaws and making necessary adjustments.

- Real-Time Testing:

- Before deploying your robot in a live trading environment, test it in real-time on a demo account. Monitor its performance and make any additional tweaks to ensure it operates effectively under current market conditions.

Developing a forex trading robot requires a solid understanding of trading strategies, programming skills, and continuous monitoring to adapt to changing market dynamics. With proper diligence and testing, a well-developed robot can significantly enhance your trading efficiency and profitability

What Platforms Support Forex Trading Robots?

Several platforms support the integration and effective operation of forex trading robots, each offering unique features and capabilities. Here are some of the top platforms:

- MetaTrader 4 (MT4):

- MetaTrader 4 is one of the most popular and widely used forex trading platforms globally. It supports a vast library of Expert Advisors (EAs) that can be used as trading bots. MT4 is known for its user-friendly interface, advanced charting tools, and extensive backtesting capabilities. It is particularly favored by beginners due to its intuitive design and comprehensive resources for automated trading.

- MetaTrader 5 (MT5):

- MetaTrader 5 is the successor to MT4 and offers enhanced features and functionalities. MT5 supports all the EAs available on MT4 and includes additional tools for automated trading, such as more advanced technical indicators and the ability to execute more complex trading strategies. MT5 is designed to handle a broader range of financial instruments, making it suitable for traders looking for a more robust trading environment.

- Thinkorswim by TD Ameritrade:

- Thinkorswim is a sophisticated trading platform offered by TD Ameritrade that supports automated trading through customized scripts and built-in trading strategies. It provides advanced charting tools, real-time market data, and comprehensive educational resources. Thinkorswim is particularly beneficial for traders in the U.S. looking for a reliable and feature-rich platform for automated trading.

What Brokers are Best for Automated Forex Trading?

Choosing the right broker is crucial for successfully implementing automated forex trading strategies. Here are some of the top brokers known for their support of automated trading:

- Trading.com:

- Trading.com offers access to MetaTrader 5, which is designed specifically for automated trading. The broker provides competitive spreads, supports trading with micro lots, and offers a straightforward trading environment. Trading.com is especially suitable for U.S. traders looking for reliable support for EAs and other automated trading tools.

- IG Markets:

- IG Markets is a well-regarded broker that supports a variety of trading platforms, including MetaTrader 4 and 5, AutoChartist, and TradingCentral. IG Markets is known for its low latency, excellent customer support, and a wide range of trading instruments, making it a good choice for traders using automated trading strategies.

- Forex.com:

- Forex.com is another top broker that offers robust support for automated trading. It provides access to MT4, MT5, and Capitalise.ai, which allows traders to create automated strategies without needing to code. Forex.com is known for its competitive spreads and comprehensive trading tools, making it a popular choice among traders.

How to Test and Optimize Forex Trading Robots

To ensure the effectiveness and profitability of forex trading robots, rigorous testing and optimization are essential. Here’s how to go about it:

- Initial Back testing:

- Run initial back tests using historical data to evaluate the robot’s baseline performance. This helps identify how the robot would have performed in past market conditions and provides a foundation for further optimization.

- Optimize Parameters:

- Adjust the robot’s input settings through iterative optimization runs to find the optimal combinations that maximize returns while minimizing drawdowns. This step involves tweaking various parameters such as stop-loss levels, take-profit targets, and other risk management settings.

- Verify with Out-of-Sample Data:

- After optimization, test the robot on out-of-sample data to ensure that its performance holds up in different market conditions. This step is crucial to avoid overfitting, where the robot performs well on historical data but fails in live trading.

- Forward Testing:

- Deploy the robot in a real-time demo trading environment to observe its performance under current market conditions. Forward testing helps identify any practical issues that may not have been evident during back testing and allows for further adjustments before going live.

Common Myths About Forex Trading Robots

Forex trading robots, or automated trading systems, are surrounded by numerous misconceptions. Understanding these myths can help traders make informed decisions.

Myth 1: Forex Trading Robots Guarantee Profits Many believe that forex robots can guarantee profits, but this is far from the truth. While these robots can execute trades based on sophisticated algorithms, they cannot eliminate the inherent risks of forex trading. Market conditions are unpredictable, and no automated system can ensure consistent profitability without occasional losses. Successful trading involves a combination of strategy, market knowledge, and risk management.

Myth 2: Forex Trading Robots Can Replace Human Traders Another common myth is that forex robots can completely replace human traders. While robots can handle trades based on predefined rules, they lack the ability to interpret complex market conditions or react to unforeseen events. Human traders bring intuition, experience, and the ability to adapt to new information, which are crucial for navigating the volatile forex market. Forex robots should be viewed as tools to enhance trading strategies, not as replacements for human judgment.

Myth 3: Forex Trading Robots Are Foolproof There is a misconception that forex robots offer foolproof trading strategies. However, no strategy is immune to market fluctuations. Forex robots are programmed based on historical data and specific indicators, which may not always predict future market movements accurately. Continuous monitoring and adjustments are necessary to ensure that the trading robot remains effective under changing market condition.

What Security Measures Should You Consider When Using Forex Trading Robots?

When using forex trading robots, implementing robust security measures is essential to protect your investments and personal data.

- Use Trusted Platforms and Brokers:

- Ensure that your trading robot operates on a reputable trading platform and that your broker is regulated by recognized financial authorities. This minimizes the risk of fraud and provides a level of assurance regarding the security of your funds.

- Regularly Update Your Software:

- Keep your trading platform and forex robot software updated to protect against vulnerabilities. Developers frequently release updates to fix security flaws and enhance performance, so it’s crucial to apply these updates promptly.

- Implement Strong Authentication:

- Use strong passwords and, if available, enable two-factor authentication (2FA) for your trading accounts. This adds an extra layer of security by requiring a second form of verification in addition to your password.

How to Integrate Forex Trading Robots with Your Trading Strategy?

Integrating forex trading robots into your overall trading strategy requires careful planning and execution.

- Align with Your Trading Goals:

- Choose a forex robot that complements your trading goals and style. Whether you are a scalper, day trader, or swing trader, ensure the robot’s strategy aligns with your objectives and risk tolerance.

- Combine Manual and Automated Trading:

- Use the robot to handle repetitive and time-consuming tasks while maintaining the ability to intervene manually when necessary. This hybrid approach allows you to leverage the efficiency of automation while applying human intuition and experience to complex decisions.

- Regular Monitoring and Adjustments:

- Continuously monitor the performance of your trading robot and make adjustments based on changing market conditions. Regular back testing and forward testing can help ensure the robot’s strategies remain effective and aligned with your trading environment.

Conclusion

Forex trading robots have significantly transformed the landscape of forex trading by automating repetitive tasks, enabling 24/7 trading, and reducing the impact of human emotions on trading decisions. While these robots offer numerous advantages, it is crucial to understand their limitations and the myths surrounding them.

Forex trading robots do not guarantee profits and cannot replace the nuanced judgment of human traders. They should be viewed as tools that enhance a trader’s strategy rather than as standalone solutions. Traders must regularly monitor and adjust their robots to adapt to changing market conditions to ensure continued effectiveness and profitability.

Security is another critical aspect when using forex trading robots. Employing trusted platforms, maintaining updated software, and using strong authentication measures are essential to safeguarding investments and personal data.

Integrating forex trading robots into a broader trading strategy can provide significant benefits. A hybrid approach, combining the efficiency of automated trading with the strategic oversight of manual trading, can lead to more effective and profitable outcomes. Continuous monitoring and adjustments based on market conditions are vital to optimizing the performance of these robots.

In conclusion, while forex trading robots can be powerful tools for enhancing trading efficiency and effectiveness, they require careful implementation, regular monitoring, and a clear understanding of their capabilities and limitations. By leveraging these automated systems wisely, traders can maximize their potential benefits while mitigating risks.

📈 Unlock the Power of Forex Trading Robots! 🤖

Dive into the world of automated trading with our comprehensive guide on Forex Trading Robots. Discover how these advanced tools can revolutionize your trading strategy by executing trades 24/7, eliminating emotional decision-making, and enhancing profitability.

In this blog, we debunk common myths, discuss essential security measures, and provide insights on integrating robots into your trading strategy. Whether you’re a beginner or a seasoned trader, our guide offers valuable tips and strategies to maximize your trading success.

👉 Read more: [Link to Blog]

#ForexTrading #AutomatedTrading #ForexRobots #TradingStrategy #Fintech #InvestmentTips

🚀 Boost Your Forex Trading with Automated Robots! 🤖💹

Are you ready to elevate your trading game? Our latest blog dives deep into the world of Forex Trading Robots, exploring how these powerful tools can transform your trading strategy. From debunking common myths to providing essential security tips and strategies for integration, we’ve got you covered!

🔍 Learn how to maximize profits, minimize risks, and stay ahead in the dynamic forex market. Perfect for both beginners and experienced traders!

📖 Read the full article: [Link to Blog]

#ForexTrading #AutomatedTrading #ForexRobots #Investment #TradingTips #Fintech #SmartInvesting

🌟 Revolutionize Your Forex Trading! 🤖💸

Discover the incredible world of Forex Trading Robots in our latest blog! Learn how these advanced tools can automate your trades, reduce emotional decision-making, and enhance your profitability. We debunk common myths, share essential security tips, and show you how to integrate robots into your strategy for maximum success.

📈 Ready to take your trading to the next level? Click the link in our bio to read more!

#ForexTrading #AutomatedTrading #ForexRobots #InvestSmart #TradingStrategy #Fintech #WealthBuilding #ForexTips #FinancialFreedom #InvestmentJourney

[Link in Bio]