What is a Stochastic Oscillator?

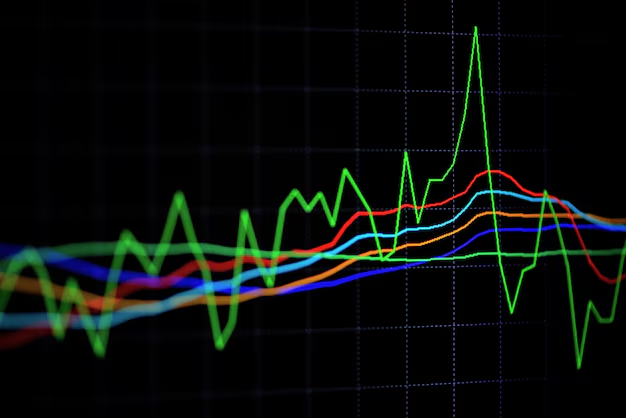

The Stochastic Oscillator is a popular momentum indicator used in technical analysis. It measures the position of an asset’s price relative to its highest and lowest prices over a specific time period. Traders use this oscillator to determine whether an asset is in an overbought or oversold zone. The primary purpose of the Stochastic Oscillator … Read more