The Forex market is the largest and most liquid financial market in the world, with a daily trading volume of over $6 trillion. It is a decentralized market where individuals, businesses, and institutions trade currencies. The Forex market is known for its volatility, and understanding market trends is crucial for traders to make informed decisions.

Types of Forex Market Trends

There are three main types of Forex market trends:

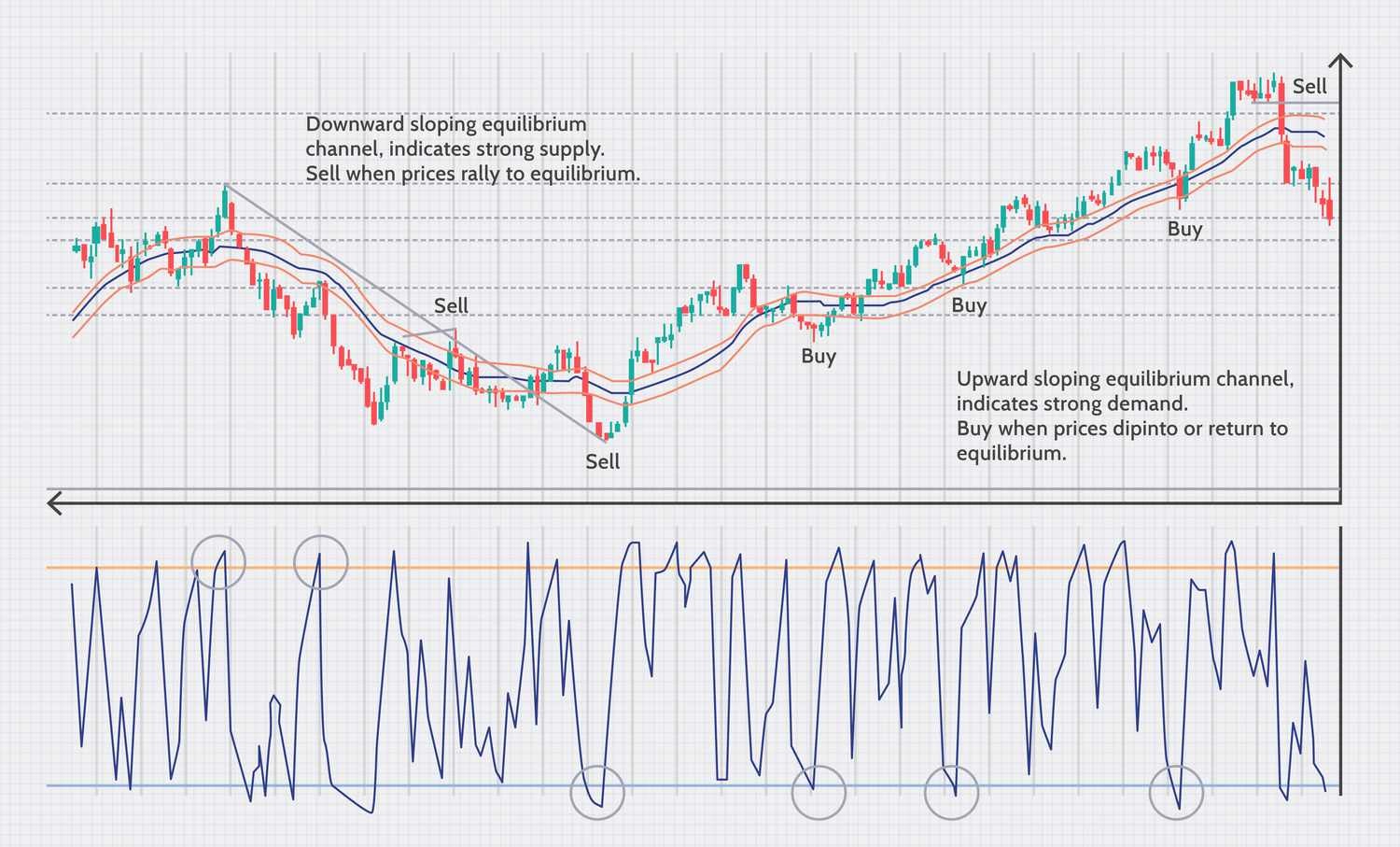

- Upward Trend: An upward trend is characterized by a series of higher highs and higher lows. It indicates a strong demand for a currency, and prices are likely to continue rising.

- Downward Trend: A downward trend is characterized by a series of lower highs and lower lows. It indicates a strong supply of a currency, and prices are likely to continue falling.

- Sideways Trend: A sideways trend is characterized by a series of horizontal highs and lows. It indicates a balanced market with no clear direction.

Causes of Forex Market Trends

Forex market trends are influenced by a combination of factors, including:

- Economic Indicators: GDP, inflation, interest rates, and employment rates can impact currency values.

- Central Bank Policies: Interest rate decisions, quantitative easing, and forward guidance can influence market trends.

- Geopolitical Events: Elections, trade wars, and natural disasters can impact market sentiment.

- Market Sentiment: Trader attitudes and positioning can influence market trends.

Identifying Forex Market Trends

To identify Forex market trends, traders use various tools and techniques, including:

- Technical Analysis: Charts, patterns, and indicators help identify trends and predict future price movements.

- Fundamental Analysis: Economic indicators, news, and events help understand market fundamentals.

- Market Sentiment Indicators: Positioning data, sentiment indexes, and put-call ratios help gauge market sentiment.

Trading with Forex Market Trends

Trading with market trends can be profitable, but it requires discipline and risk management. Here are some tips:

- Trade in the direction of the trend: Identify the trend and trade in its direction.

- Use risk management: Set stop-loss orders and limit position size.

- Monitor and adjust: Continuously monitor the market and adjust trading strategies.

Conclusion

Forex market trends are a crucial aspect of trading in the Forex market. Understanding the types of trends, their causes, and how to identify them can help traders make informed decisions. Trading with market trends requires discipline and risk management, but it can be a profitable strategy. By staying informed and adapting to changing market conditions, traders can navigate the Forex market with confidence.

monitor SEC vs. crypto case-related updates on Thursday, July 18.

monitor SEC vs. crypto case-related updates on Thursday, July 18.